/Contractors%20Optimistic%20-%202.4.19%20-%20GettyImages-1042342584.jpg)

This article originally was published by For Construction Pros on September 6, 2018, and written by the USG Corporation. It appears below in its original entirety including the images.

88% of contractors expect at least a moderate impact from workforce shortages in the next three years, with more than half expecting the impact to be severe.

/Q3%20USG%20Construction%20Index.jpg?width=419&name=Q3%20USG%20Construction%20Index.jpg)

Improvement in the Q3 2018 USG Corporation + U.S. Chamber of Commerce Commercial Construction Index was likely driven by an increase in backlog figures since Q2.

/Contractors%20Optimistic%20-%202.4.19%20-%20GettyImages-1042342584.jpg?width=300&name=Contractors%20Optimistic%20-%202.4.19%20-%20GettyImages-1042342584.jpg) Contractors in the U.S. commercial construction industry report overall optimism about the construction market in the third quarter of 2018. This comes despite contractors’ ongoing challenges with skilled workforce availability and tariff-related concerns. A two-point increase in the Q3 2018 USG Corporation + U.S. Chamber of Commerce Commercial Construction Index was likely driven by an increase in the backlog figures since Q2 2018, as respondents’ confidence in new business opportunities and revenue for the quarter declined slightly.

Contractors in the U.S. commercial construction industry report overall optimism about the construction market in the third quarter of 2018. This comes despite contractors’ ongoing challenges with skilled workforce availability and tariff-related concerns. A two-point increase in the Q3 2018 USG Corporation + U.S. Chamber of Commerce Commercial Construction Index was likely driven by an increase in the backlog figures since Q2 2018, as respondents’ confidence in new business opportunities and revenue for the quarter declined slightly.

Other important results of research for the quarterly Commercial Construction Index indicates skilled labor shortages will have the greatest impact on businesses over the next three years. The report revealed 88% of contractors expect to feel at least a moderate impact from the workforce shortages in the next three years with over half (57%) expecting the impact to be high/very high.

Other important results of research for the quarterly Commercial Construction Index indicates skilled labor shortages will have the greatest impact on businesses over the next three years. The report revealed 88% of contractors expect to feel at least a moderate impact from the workforce shortages in the next three years with over half (57%) expecting the impact to be high/very high.

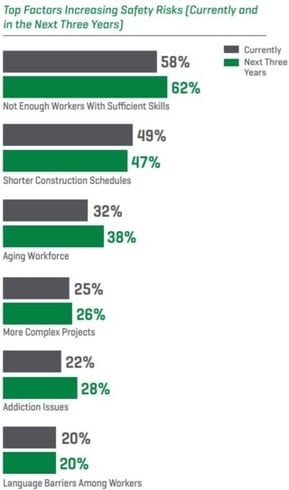

The skilled labor shortage has been consistently identified as a major issue facing the industry, but it is now reported by 80% of contractors to be impacting the worker and job site safety. In fact, the Q3 report found that a lack of skilled workers was the number one factor impacting increased job site safety risks (58%).

"The commercial construction industry is growing but the labor shortage remains unresolved," said Jennifer Scanlon, president and CEO of USG Corporation. "As contractors are forced to do more with less, a renewed emphasis on safety is imperative to the strength and health of the industry. It continues to be important for organizations to build strong and comprehensive safety programs."

As contractors grapple with a scarcity of skilled workers, findings show a majority are working to improve the overall safety culture on the job site (63%) and at their firm's offices (58%). However, the indicators that were reported to have the highest impact on improving safety culture and outcomes are those that engage employees throughout the organization. This includes developing training programs for all levels of workers (67%), ensuring accountability across the organization (53%), and empowering and involving employees (48%). Other indicators reported include improving communication (46%), demonstrating management's commitment to safety (46%), improving supervisory leadership (43%), and aligning and integrating safety as a value (42%).

In addition to the skilled labor shortage, the report found addiction and substance abuse issues are a factor in worker and job site safety. Nearly forty percent of contractors are highly concerned over the safety impacts of worker use/addiction to opioids, followed by alcohol (27%) and marijuana (22%). Notably, the report showed that while nearly two-thirds of contractors have strategies in place to reduce the safety risks presented by alcohol (62%) and marijuana (61%), only half have strategies to address their top substance of concern: Opioids, which is a newer growing concern. The opioid epidemic cost our economy $95 billion in 2016 and could account for approximately 20% of the observed decline in men's labor force participation.

"The opioid crisis has both human and economic costs," said Neil Bradley, chief policy officer of the U.S. Chamber. "The U.S. Chamber of Commerce remains committed to helping combat the opioid epidemic, which continues to devastate too many families, communities, and industries every day. While there is no one-size-fits-all answer, a multipronged legislative approach is a critical first step."

Overall contractor sentiment saw a slight boost in optimism with an Index score of 75 in the third quarter — up two points from Q2 2018. The Index looks at the results of three leading indicators to gauge confidence in the commercial construction industry — backlog, new business opportunities, and revenue forecasts — generating a composite index on the scale of 0 to 100 that serves as an indicator of the health of the contractor segment on a quarterly basis.

Overall contractor sentiment saw a slight boost in optimism with an Index score of 75 in the third quarter — up two points from Q2 2018. The Index looks at the results of three leading indicators to gauge confidence in the commercial construction industry — backlog, new business opportunities, and revenue forecasts — generating a composite index on the scale of 0 to 100 that serves as an indicator of the health of the contractor segment on a quarterly basis.

The Q3 2018 results from the three key drivers were:

- Backlog: Optimal backlog rose from 73 to 81, the largest change in any of the three components of the CCI in the last six quarters. The average current backlog was 10.3 months, up from 9.3 last quarter.

- New Business: The level of overall confidence was 74, relatively steady quarter-over-quarter (75 in Q2 2018) but down two points since Q1 (76).

- Revenues: Expectations slipped from 72 to 69, the most notable change coming in a decrease in the age of contractors who now expect an increase in revenues, which dropped from 83% to 72%.

Read the Q3 2018 Commercial Construction Index report

About the Index

The USG Corporation + U.S. Chamber of Commerce Commercial Construction Index is a quarterly economic index designed to gauge the outlook for, and resulting confidence in, the commercial construction industry. USG Corporation and the U.S. Chamber produce this Index, along with Dodge Data & Analytics (DD&A). Each quarter, researchers from DD&A source responses from their Contractor Panel of more than 2,700 commercial construction decision-makers in order to better understand their levels of confidence in the industry and other key trends. This panel allows DD&A to provide findings that are representative of the entire U.S. construction industry by geography, size, and type of company.